Will Tungsten Be Traded Globally in RMB?

— Strategy and Policy for Building a RMB-Denominated Settlement System for Critical Minerals

In 2005, China Tungsten Online published its views on Chinese tungsten product prices on its website www.fwnddto.cn,proposing for the first time that tungsten products should be priced in RMB globally. It referred to this as the FOBOW, China price, meaning the delivery price of tungsten products at Chinese ports. As times have changed, revisiting the concept of a Chinese-port-RMB-delivery price reflects a renewed understanding of the scarcity of China’s tungsten products. The use of RMB for pricing and settlement in tungsten products not only recognizes the value of China’s tungsten resource endowment but also reflects China’s influence across the tungsten industry chain.

I. Background and Strategic Window: Opportunities Amid the Reconstruction of the Global Financial Order

The global political, economic, and financial order is undergoing profound restructuring. Since 2018, China–US economic and trade frictions have evolved from tariff disputes to comprehensive competition characterized by technological blockade, industrial decoupling, financial confrontation, and geopolitical pressure. Through the CHIPS and Science Act, the Inflation Reduction Act, and other policies, the United States has built a “technology-energy-finance” integrated containment system aimed at weakening China’s competitiveness in key industrial chain segments. In response, China has recently introduced a series of measures involving critical minerals and tariffs.

Geopolitical uncertainty is rising significantly worldwide. The Russia–Ukraine conflict, escalating tensions between Israel and Palestine, and recurring disruptions along the Red Sea corridor are reshaping global raw material and energy supply systems. The United States and its allies have reinforced dollar-centric financial dominance, using mechanisms such as SWIFT to impose sanctions, raising broad concerns about the safety and fairness of the dollar system. On November 10, 2025, the London Metal Exchange (LME) abruptly announced the suspension of all non-dollar-denominated metal options, further exposing systemic risks stemming from the global dependency on dollar-based resource pricing.

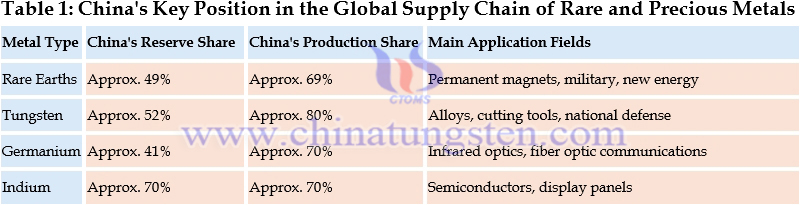

Just one month earlier, on October 9, 2025, Australian mining giant BHP signed an agreement with China Mineral Resources Group to adopt RMB settlement for iron ore exports to China starting in the fourth quarter. China possesses irreplaceable resource and technological advantages in tungsten, rare earths, molybdenum, indium, germanium, and other critical metals. Key data are shown below:

Table 1: China's Key Position in the Global Supply Chain of Rare and Precious Metals

China controls the full industry chain from mining, smelting, and refining to high-end applications for tungsten and other critical minerals. China has irreplaceable capabilities in sectors such as rare-earth permanent magnets and high-purity tungsten products. These resources support high-end manufacturing, aerospace, nuclear energy, and new energy vehicles, and serve as “technology metals” and “geoeconomic leverage” in medium-to-long-term strategic competition.

Against the backdrop of intensified systemic competition between China and the US, increasing challenges to dollar hegemony, and restructuring of global supply chains, promoting RMB pricing and settlement for tungsten, rare earths, and other critical metals can help China build a new global trade-and-finance ecosystem. It can weaken the dominance of the dollar, enhance the international role of the RMB, and achieve integrated advancement of resources, industry, and currency. At the same time, it can help Shanghai and Hong Kong strengthen their status as international financial centers by leveraging China’s resource advantages and industrial strengths.

II. Feasibility Analysis: The Realistic Foundation of Resource Control & Market Influence

2.1 Resource endowment and production dominance

China maintains a strong material foundation in critical metals. As of 2024, global tungsten reserves are approximately 4.6 million metric tons of metal content, of which China holds about 2.4 million tons (52%). China accounts for over 80% of global tungsten concentrate output, around 70% of rare-earth oxide output, and approximately 85% of rare-earth metal refining and magnet manufacturing. China also leads in refining and advanced processing of molybdenum, germanium, indium, tantalum, niobium, and other high-purity metals. This vertically integrated structure creates a strong foundation for a RMB-denominated pricing system.

Notably, China’s control extends well beyond raw materials and into deep processing and materials applications. China has established global technological barriers in high-purity nano-tungsten oxide, high-purity metallic tungsten, specialty tungsten chemicals such as tungsten hexafluoride (WF?) and tungsten disulfide (WS?), and high-performance rare-earth permanent magnets. China leads the world in high-temperature atmosphere control, electrolytic purification, vacuum sintering, and precision machining. Although some foreign countries possess mineral deposits, most continue to rely on China’s smelting and processing capabilities, further enhancing China’s influence in the global supply chain.

2.2 Industrial and supply chain control

China’s control of critical-metal supply chains covers the entire value chain. In rare earths, China not only dominates global oxide production but also commands over 90% of the permanent-magnet market. China has also established a comprehensive domestic production and reserve system. Through consolidation of mining assets, stricter environmental standards, and optimized industrial layout, China has improved its regulatory leverage over the supply chain.

2.3 Market dependency and bargaining power

Advanced manufacturing in Japan, South Korea, Europe, and North America depends heavily on China’s supply of critical metals such as tungsten and rare-earth magnets, with limited short-term substitutes. Through export quotas, resource-total-volume controls, and industrial-access rules, China holds substantial bargaining power in pushing for RMB pricing.

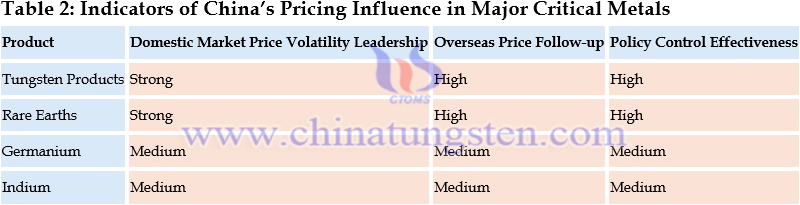

Table 2: Indicators of China’s Pricing Influence in Major Critical Metals

Price-transmission patterns show that Chinese domestic prices directly lead global markets. Since early 2025, domestic prices for 65% black tungsten concentrate rose from RMB 143,000/ton to RMB 318,000/ton, and APT from RMB 211,000/ton to RMB 475,000/ton—an increase of over 120%. Overseas prices rose about 110% in parallel. Export-control measures and supply tightening caused foreign prices to trace China’s market rhythm, highlighting China’s dominant position in global tungsten value chains.

III. Possibility Analysis: Institutional and Market Conditions for RMB Pricing

3.1 Development of financial infrastructure

The Cross-Border Interbank Payment System (CIPS) has connected over 1,100 overseas institutions across six continents. RMB clearing banks operate in Hong Kong, London, and Singapore. China has established extensive currency-swap agreements to support RMB liquidity. The Shanghai Futures Exchange and the Shanghai International Energy Exchange already have mechanisms for RMB-denominated futures and deliverable warehouse receipts, enabling construction of RMB-pricing systems for tungsten and rare earths.

In early November 2025, the China Securities Regulatory Commission approved platinum and palladium futures and options on the Guangzhou Futures Exchange, bringing China’s total number of futures products to over 160. These contracts are traded in RMB during Asian hours and could form a “third price curve” apart from London and New York. This experience is directly applicable to future RMB-denominated tungsten and rare-earth futures. China Tungsten Online is aware that relevant exchanges have already conducted multi-year research and testing on potential tungsten futures—such as APT and tungsten concentrates—and are fully prepared to launch RMB-denominated tungsten futures once timing and policy align.

3.2 International market conditions and acceptance

Global economies are accelerating de-dollarization. Saudi Arabia, the UAE, Brazil, Russia, and others have begun adopting RMB settlement. The RMB has surpassed the euro in global trade settlements. Major Middle Eastern wire-rod producers have announced that long-term metal contracts will reference Shanghai prices and be settled in RMB starting late 2025. Dubai plans to launch RMB-denominated metals futures in 2026, with delivery warehouses in Jebel Ali Port.

Large global miners such as BHP and Vale have been accepting RMB settlement for iron ore for several years, with the share steadily rising. This shift is market-driven rather than politically imposed. Using RMB reduces transaction costs and minimizes exchange-rate risk, making the model more sustainable.

IV. Necessity Analysis: National Security and Financial Sovereignty

4.1 Resource sovereignty and financial security

Dollar dominance in global commodity pricing allows the US to indirectly influence resource prices. Replacing the dollar with the RMB in key resources enhances China’s financial and energy security and reduces sanction risks. The long-term fragility and weaponization of the dollar drive emerging economies and countries with structural differences from the US to diversify their reserve currencies. The RMB—supported by its purchasing power, stability, and economic scale—is becoming the most important marginal alternative to the dollar.

The adoption of RMB settlement for tungsten, rare earths, and other critical metals has profound implications. RMB settlement for commodities such as iron ore and crude oil reflects shifts in global trade patterns and economic power. China’s economic scale and resource demand are too large to be fully locked within a dollar-centric system. The pricing monopoly of the petrodollar is a pillar of US financial hegemony. As more critical resources accept non-dollar settlement, the foundation of the petrodollar weakens, paving the way for a multipolar global currency system.

4.2 A strategic breakthrough for RMB internationalization

Building RMB pricing in high-value, irreplaceable critical metals embeds the RMB into the core of global industrial chains through real trade, creating a more stable and deeper foundation than financial-market liberalization alone. Experts at the People’s Bank of China emphasize differentiated strategy across regions—Southeast Asia, Africa, OPEC members, and Belt-and-Road countries—expanding RMB usage through complementary trade and investment.

The launch of platinum and palladium futures provides a path to expand the international influence of “China prices.” According to analysts at Galaxy Futures, RMB-denominated platinum and palladium futures will form fair, continuous market prices that reflect China’s supply-demand fundamentals, increasing China’s pricing power in global precious metal markets.

V. Policy Roadmap: A Systematic Plan Centered on the Domestic Futures Market

To transform China’s resource and technological advantages into monetary influence, a coordinated system is required—from domestic markets to global systems, and from physical trade to financial deepening. The following framework follows the principles of “inside-out, physical-to-financial, point-to-network.”

5.1 Step one Strengthen domestic pricing foundations and build RMB futures contracts

Core measures for establishing RMB pricing in tungsten:

—Launch RMB-denominated futures for tungsten, rare earths, and other strategic metals on the Shanghai Futures Exchange or the Guangzhou Futures Exchange.

Contract design aligned with global standards:

—Start with standardized and mature products such as APT or praseodymium-neodymium oxide.

—Establish China-based delivery standards comparable to global norms.

—Adopt transparent, international-standard trading, clearing, and risk-control frameworks.

—Draw on successful models from the Shanghai Gold Benchmark and the INE crude oil futures in facilitating cross-border participation.

Ecosystem development:

—Loosen restrictions on tungsten scrap imports; encourage producers and traders to use domestic futures for hedging.

—Introduce market-maker mechanisms; expand access for qualified foreign investors.

—Ultimately build an authoritative RMB pricing center with broad global participation.

5.2 Step two: Build multi-layered markets and expand offshore hubs

—Develop RMB price indices, OTC swaps, and options for tungsten and rare earths.

—Strengthen Hong Kong as an offshore RMB commodities hub, with complementary financial products and bonded warehouses for tungsten and rare earths.

5.3 Step three: Promote bilateral and multilateral adoption

—Promote RMB pricing in long-term supply contracts with long-standing, compliant trading partners.

—Provide credit-support tools, export-credit insurance, and settlement convenience through CIPS and policy-finance institutions.

5.4 Final objective: Institutional influence and global pricing power

These steps aim to make “China prices” a critical reference in global metals markets, and to make RMB pricing a viable and increasingly preferred option worldwide.

VI. Risks and Countermeasures

6.1 Geopolitical and trade retaliation

The US and EU may respond with sanctions, SDN listings, or restrictions on dollar clearing. Countermeasures include:

—Sharing China’s mining, processing, and tariff-preference advantages with friendly Belt-and-Road partners.

—Building a RMB-pricing alliance through BRICS and the SCO.

—Developing legal mechanisms including the Anti-Foreign-Sanctions Law and establishing specialized international commercial courts.

6.2 Financial-market and exchange-rate risks

—Develop offshore RMB derivatives; encourage banks to offer low-cost hedging.

— stablish a risk-mitigation fund for foreign users adopting RMB settlement.

—Expand RMB liquidity pools through swaps and central-bank coordination.

6.3 Market transparency and credibility

Acceptance of RMB pricing depends on transparency and fairness. China must:

—Establish international-standard reporting and auditing for RMB pricing platforms.

—Improve governance structures and allow reputable international institutions oversight.

—Ensure transparent market information to avoid manipulation concerns.

Table 3: Major Risks and Corresponding Strategy System

VII. Conclusion and Outlook

Tungsten, rare earths, and other critical metals are China’s strategic high ground in global industrial chains, with inherent advantages for RMB pricing. The global metals-pricing system is undergoing structural change; cracks in dollar dominance are emerging, creating a window for substantive RMB internationalization.

Strategically, RMB pricing enables China to shift from a resource supplier to a rule-shaper in critical minerals. Strengthened export controls on tungsten and rare earths will reshape global trade order and promote sustainable development of global tungsten and rare-earth industries. At the same time, RMB pricing will help domestic firms pursue technological upgrading rather than low-price competition.

From an implementation perspective, forming a multipolar pricing system—dollar, euro, RMB—would allow global traders greater flexibility and help China secure strategic resources under any external financial shock. This aligns with the interests of most economies and provides a buffer against unilateral financial sanctions.

Implementing RMB pricing in tungsten and other critical minerals is supported by solid realities, serves national-security needs, and aligns with the long-term strategy of RMB internationalization—marking a crucial step in reshaping the global monetary landscape. A domestic futures-centered approach, supported by financial infrastructure and trade diplomacy, will enable China to gain greater influence in global economic governance.

However, based on the above analysis, we believe that if critical minerals such as tungsten and rare earths were to be priced and traded in RMB in the future, it would serve as an initial temporary response to the LME's exclusion policy against non-U.S. dollar futures, rather than stemming from China's subjective intention.

Notes and Disclaimers

The entire content above has been collected, organized, and translated by AI. Under no circumstances or at any time shall the publisher be held responsible for its accuracy, reasonableness, or legality. It should not be considered as advice or strategies for any transactions, investments, or negotiations. Readers are advised to refer to relevant Chinese and English materials for verification and reference.