Analysis of Latest Tungsten Market from Chinatungsten Online

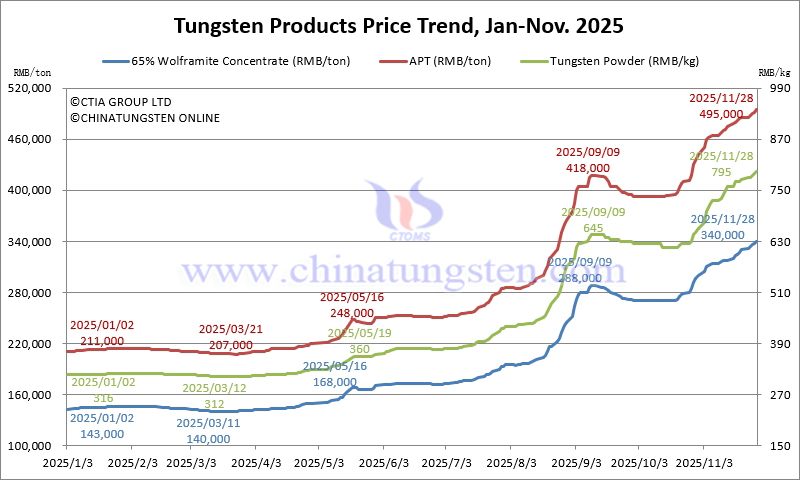

In November 2025, the Chinese tungsten market exhibited a strong upward trend, with resilience significantly exceeding market expectations. The core drivers stemmed from multiple positive factors within a tight supply-demand balance: strong bullish sentiment among sellers, increased long-term contract prices from major enterprises, a synchronized rise in international tungsten product prices, and the heightened strategic value of tungsten resources amid intensified global competition for key minerals.

In the first half of the month, tungsten powder products led the price increases, with daily price increases of RMB 10,000/ton driving a rapid rise in market sentiment. In the second half of the month, the tungsten ore market showed a moderate but firm upward trend, continuing to push prices up across the entire industry chain. Faced with a cumulative increase of approximately 150% in tungsten raw material costs, tungsten material, tungsten alloy, and cemented carbide companies successively initiated their 5th-6th rounds of price adjustments this year. Simultaneously, sentiment in the scrap tungsten market warmed, with prices tentatively rising, and trading strategies generally focused on "quick in, quick out" to mitigate the risks of capital and price fluctuations.

Overall, there are currently no clear signs of a peak in tungsten prices, and the strong performance of the tungsten concentrate market provides solid support for the overall market trend. However, the high price environment has put some pressure on end-user demand, with the market generally exhibiting a coexistence of cautious observation and a mix of "chasing high prices" and "fear of high prices," resulting in an overall slowdown in procurement. Looking ahead, marginal adjustments in supply and demand, shifts in market sentiment, and uncertainties in the international political and economic situation will remain key variables influencing tungsten price trends.

In the international market, as of press time, European APT prices were quoted at USD 735-780/mtu (equivalent to RMB 461,000-489,000/ton), up 129.6% from the beginning of the year. European ferrotungsten prices were quoted at USD 94-96/kg W (equivalent to RMB 466,000-476,000/ton), up 115.9% from the beginning of the year.

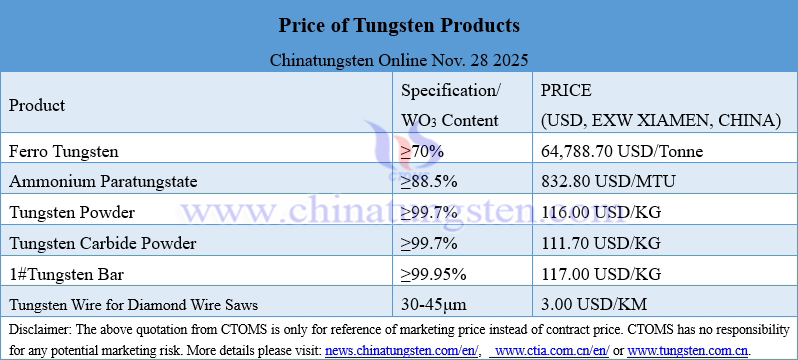

Prices of Tungsten Products on November 28, 2025

Tungsten Price Trend from January to November 28, 2025