Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market is in a bull phase, with prices steadily rising. This is mainly due to tight raw material supply, capital market intervention, and better-than-expected long-term contract purchase prices from tungsten companies at the beginning of the week. Downstream users remain cautious about the rapidly rising costs, but some rigid demand has been forced to accept them. Liquidity in the tungsten market is limited, with transactions concentrated on long-term contract fulfillment, and spot market activity is low.

In the tungsten concentrate market, mining companies' inventory value has increased significantly. Before facing significant financial pressure, the market is cautious in its sales, low-priced supplies are scarce, and bullish sentiment remains strong.

65% wolframite concentrate was priced at RMB 347,000/ton, up 142.7% from the beginning of the year.

65% scheelite concentrate was priced at RMB 346,000/ton, up 143.7% from the beginning of the year.

In the ammonium paratungstate (APT) market, benefiting from cost transmission and firm long-term contract prices from major companies, prices remain on an upward trend. Demand feedback is relatively cautious, with focus on fulfilling long-term contracts, and the spot market is quiet.

Domestic APT was priced at RMB 510,000/ton, up 141.7% from the beginning of the year.

European APT was priced at USD 735-780/mtu (equivalent to RMB 460,000-488,000/ton), up 129.6% from the beginning of the year.

In the tungsten powder market, with raw material prices remaining high, suppliers were reluctant to proactively quote prices, opting for negotiated deals on a case-by-case basis. Buyers mostly adopted a wait-and-see approach, with actual transactions mainly concentrated on small-batch, rigid demand orders.

Tungsten powder was priced at RMB 810/kg, up 156.3% from the beginning of the year.

Tungsten carbide powder was priced at RMB 780/kg, up 150.8% from the beginning of the year.

Cobalt powder was priced at RMB 510/kg, up 200% from the beginning of the year.

In the ferrotungsten market, prices rose in tandem, but high prices hampered actual trade flow. Steel mills' bidding volume and price coordination were limited, and the market's pace of price increases was somewhat cautious.

70% ferrotungsten was priced at RMB 470,000/ton, up 118.6% from the beginning of the year.

European ferrotungsten was priced at USD 94-96/kg W (equivalent to RMB 465,000-475,000/ton), up 115.9% from the beginning of the year.

In the tungsten waste and scrap market, as an important supplementary supply channel, prices have risen along with mainstream tungsten product prices. However, traders tend to operate on a short-term basis, with fast turnover of market sources and frequent changes in supply and demand relationships, which increases the risk of price fluctuations.

Scrap tungsten rod was priced at RMB 495/kg, up 125% from the beginning of the year.

Scrap tungsten drill bit was priced at RMB 470/kg, up 106.1% from the beginning of the year.

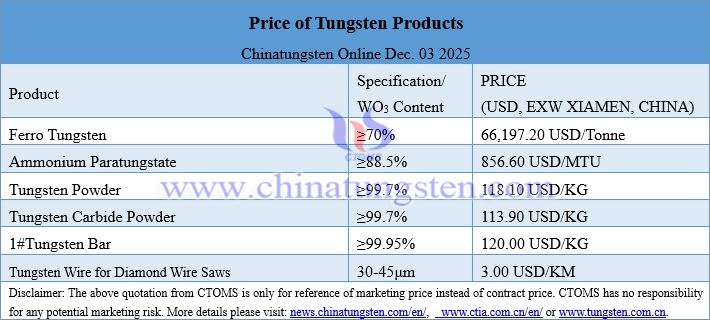

Prices of Tungsten Products on December 3, 2025

Tungsten Price Trend from January to December 3, 2025