Analysis of Latest Tungsten Market from Chinatungsten Online

A term trending on social media today is "emotional consumption," referring to consumer behavior driven by emotional needs rather than purely utilitarian purposes. This phenomenon has fueled the "emotional economy" boom. Interestingly, this concept reflects the current dynamics of the tungsten market to some extent.

Since the beginning of this year, tungsten prices have surged, with an increase of over 120% so far. This surge is not solely driven by supply and demand, but also significantly fueled by market sentiment. However, while the "emotion" in the tungsten market and the emotional economy in the consumer sector have some similarities, they are fundamentally different. The latter refers more to end-consumers paying for emotional satisfaction. The former is based on scarce resources, strategic attributes, and rigid demand; market sentiment is merely a catalyst, primarily stemming from changes in expectations from suppliers and investors. However, tungsten consumers are currently under significant pressure due to high costs, generally cautiously purchasing based on rigid needs or stockpiling opportunistically, resulting in a generally negative emotional experience.

It is worth noting that with the existence of an "emotional economy," one must be wary of "emotional bubbles." When market sentiment deviates excessively from actual supply and demand, it can create an "emotional bubble". Especially given that tungsten prices have already more than doubled from previous highs, any market fluctuations can be amplified by sentiment, exacerbating price volatility. Therefore, industry professionals are advised to remain rational, closely monitor marginal changes in supply and demand and policy trends, guard against various operational risks, and maintain strategic composure in the market heat.

As of press time:

65% wolframite concentrate is priced at RMB 318,000/ton, up 122.4% from the beginning of the year.

65% scheelite concentrate is priced at RMB 317,000/ton, up 123.2% from the beginning of the year.

Ammonium paratungstate (APT) is priced at RMB 472,000/ton, up 123.7% from the beginning of the year.

European APT is priced at USD 647.5-700/mtu (equivalent to RMB 408,000-441,000/ton), up 104.2% from the beginning of the year.

Tungsten powder is priced at RMB 750/kg, up 137.3% from the beginning of the year.

Tungsten carbide powder is priced at RMB 725/kg, up 133.1% from the beginning of the year.

Cobalt powder is priced at RMB 510/kg, up 200% from the beginning of the year.

70% ferrotungsten is priced at RMB 435,000/ton, up 102.3% from the beginning of the year.

European ferrotungsten is priced at USD 92-94/kg W (equivalent to RMB 458,000-468,000/ton), up 111.4% from the beginning of the year.

Scrap tungsten rods are priced at RMB 470/kg, up 113.6% from the beginning of the year.

Scrap tungsten drill bits are priced at RMB 437/kg, up 91.7% from the beginning of the year.

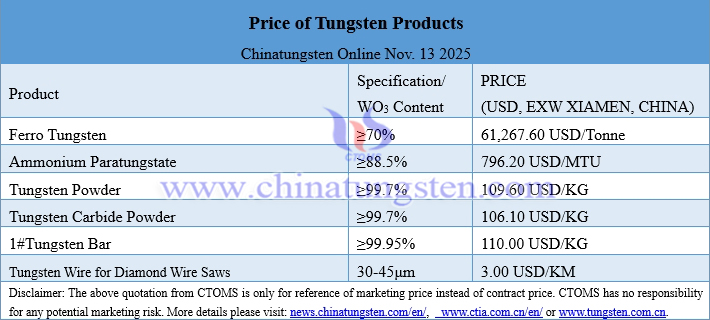

Prices of Tungsten Products on November 13, 2025

Tungsten Price Trend from January to November 13, 2025